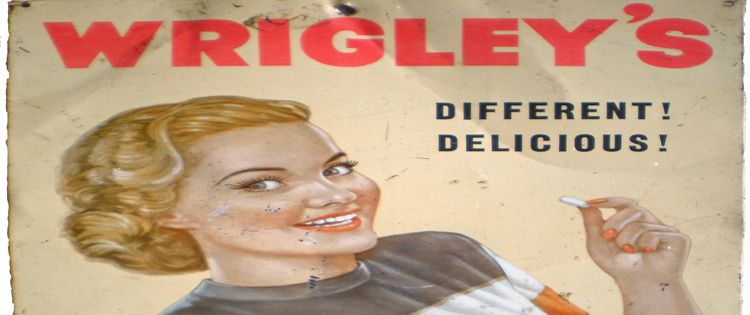

William Wrigley Jr. II., the scion of the family that made great wealth by making and selling the most popular chewing gum in the world is setting his eyes and is moving into the cannabis industry.

Wrigley, who helped arrange the sale of his family’s whole business to Mars Inc. in 2008, managed to bring in $65 million worth of investments for Surterra Wellness, a medical cannabis startup based in Georgia. This cannabis startup is licensed to operate in Texas and Florida.

According to Surterra, with Wrigley’s additional investment, the total funding for their cannabis startups has now reached $100 million.

After leaving the candy and gum industry, Wrigley who is now 54, currently invests in companies with his personal investment arm situated in West Palm Beach, Florida.

After their initial investment in the medical cannabis company in September, Wrigley is pushing his stake and has taken the role of chairman for Surterra. The company is his first direct venture in the cannabis industry.

Also known as Beau, Wrigley said that he got into the cannabis industry primarily because that he believes the medical benefits of cannabis.

He added that he will use his experience in his past business ventures, particularly brand building and product distribution to drive the growth of Surterra Wellness.

As of this time, the cannabis company has 10 medical dispensaries operating in Florida.

The company also has a license to operate in the nascent market of Texas.

When he was asked for a public comment on his first interview after he made the investment to Surterra, Wrigley said that he changed his mind and perception on cannabis when he learned about the substance’s therapeutic benefits.

He added that investors like himself don’t have that much opportunity to have this kind of impact in an industry that is still in its earliest stage.

Wrigley Co. was founded in 1891 by Wrigley’s great-grandfather. Passing on the billions to William, the heir is now studying to invest in the burgeoning market of recreational cannabis after providing funding for a medical cannabis company.

He said this after seeing the market for the adult use of cannabis recently hitting the East Coast on Massachusetts.

But he is still watching the recreational cannabis industry closely as more states are looking into cashing in on legal sales for recreational cannabis even though the federal government still deems the substance illegal.

Some states across the U.S. have now allowed and legalized the use of medical cannabis, and more are to follow suit soon.

Even the FDA, which classifies cannabis in the Schedule I categorization, referred a cannabis-derived drug earlier this year. The FDA’s classification of cannabis states that cannabis has no medical use, can cause health concerns and has a high abuse potential. Most of these assumptions have been proven incorrect.

Wrigley even believes it will be likely that the federal government will take some more steps to relax the regulations that limit the potential of cannabis.

So far, because of the federal prohibition on cannabis, it has mostly hindered cannabis businesses from accessing banking services, big institutions, and potential investors from taking part in the cannabis investment boom.

In Canada, huge preparations in the government and business sectors are being made for the legalization of the cannabis for adult use on October 17 this year, with hefty sums of dollars pouring across the border.

With his advisory, Wrigley plans to eventually make Surterra participate in the market for recreational cannabis use domestically. Experts forecast the market to grow to more than $5 billion annually.

Currently, there are nine states that have legalized the sale and consumption of cannabis for adult use. According to a report by BDS Analytics and Arcview Market Research, if the sales of medical cannabis will be included for the count, the U.S. market has a potential to reach $11 billion this year.

Although some are still hesitant to enter the cannabis market because of the federal prohibition, the influx of billions of dollars into the legal economy of the United States from the underground market is drawing in a lot of interest from investors.

“Everyone seems to be in there because they think they’re going to make tons of money,” Wrigley said. “Some will and some will be sorely surprised when they understand how complex it is.”

- How Commercial Cannabis Growers Can Benefit from Using a Software - May 17, 2019

- Understanding CBD Interactions and Why CBD and Your Brain Can Be Best Friends - January 4, 2019

- The Difference Between Using THC and CBD - December 19, 2018